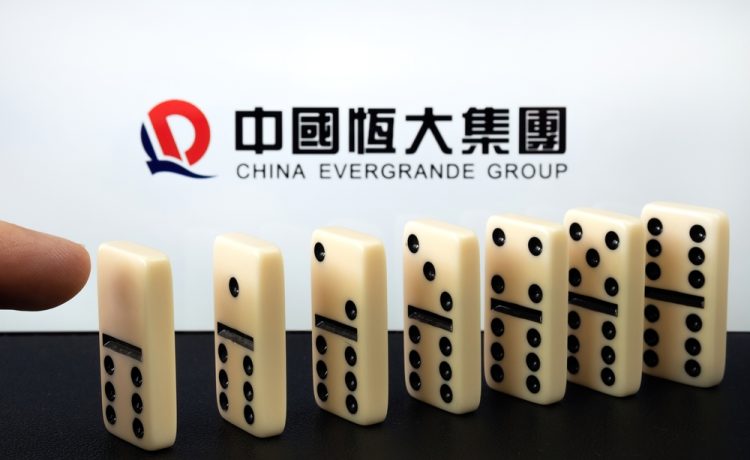

Failure by Evergrande to make $82.5 million in interest payments due last month on some U.S. dollar bonds would trigger cross-default on its roughly $19 billion of international bonds

China Evergrande Group’s shares hit an all-time low on Wednesday after a missed debt payment deadline put the developer at risk of becoming China’s biggest defaulter, although hopes of a managed debt restructuring calmed fears of a messy collapse.

So far, any Evergrande fallout has been broadly contained, and with policymakers becoming more vocal and markets more familiar with the issue, consequences of its troubles are less likely to be widely felt, market watchers have said.

Failure by Evergrande to make $82.5 million in interest payments due last month on some U.S. dollar bonds would trigger cross-default on its roughly $19 billion of international bonds, with possible ramifications on China’s economy and beyond.

Evergrande’s shares were down 1.6% at 0310 GMT at HK$1.80 ($0.23), after earlier hitting HK$1.78 ($0.23) – their lowest since the November 2009 debut. The broader market was steady.

Its notes due on Nov. 6, 2022, one of two tranches with a coupon payment deadline that passed on Monday, traded at 18.642 cents on the dollar, Duration Finance data showed, versus 18.875 from the close of Tuesday Asia hours.

Trading in shares of embattled smaller peer Kaisa Group Holdings was suspended on Wednesday, after a source with direct knowledge of the matter said it was unlikely to meet its $400 million offshore debt deadline on Tuesday.

Kaisa, China’s largest holder of offshore debt among developers after Evergrande, had not repaid the 6.5% bond by the end of Asia business hours, the person said, which could push the notes into technical default, triggering cross defaults on its offshore bonds totalling nearly $12 billion.

Bondholders owning over 50% of the notes in question sent the company draft terms of forbearance late on Monday, a source previously told Reuters.

Even in the case of a technical default, Kaisa and offshore bondholders would continue the discussions, two sources with knowledge of the matter said.

Kaisa’s bond due April 2022 traded at 36.906, up a little from the day earlier but down from 37.89 last week.