U.S. stocks slipped after a warning from President Donald Trump to China pressured technology shares

U.S. stocks slipped on Tuesday after a warning from President Donald Trump to China pressured technology shares, while investors looked to an expected interest rate cut at the conclusion of the Federal Reserve’s monetary policy meeting.

The three major U.S. stock indexes were in the red, pressured by consumer discretionary and technology stocks.

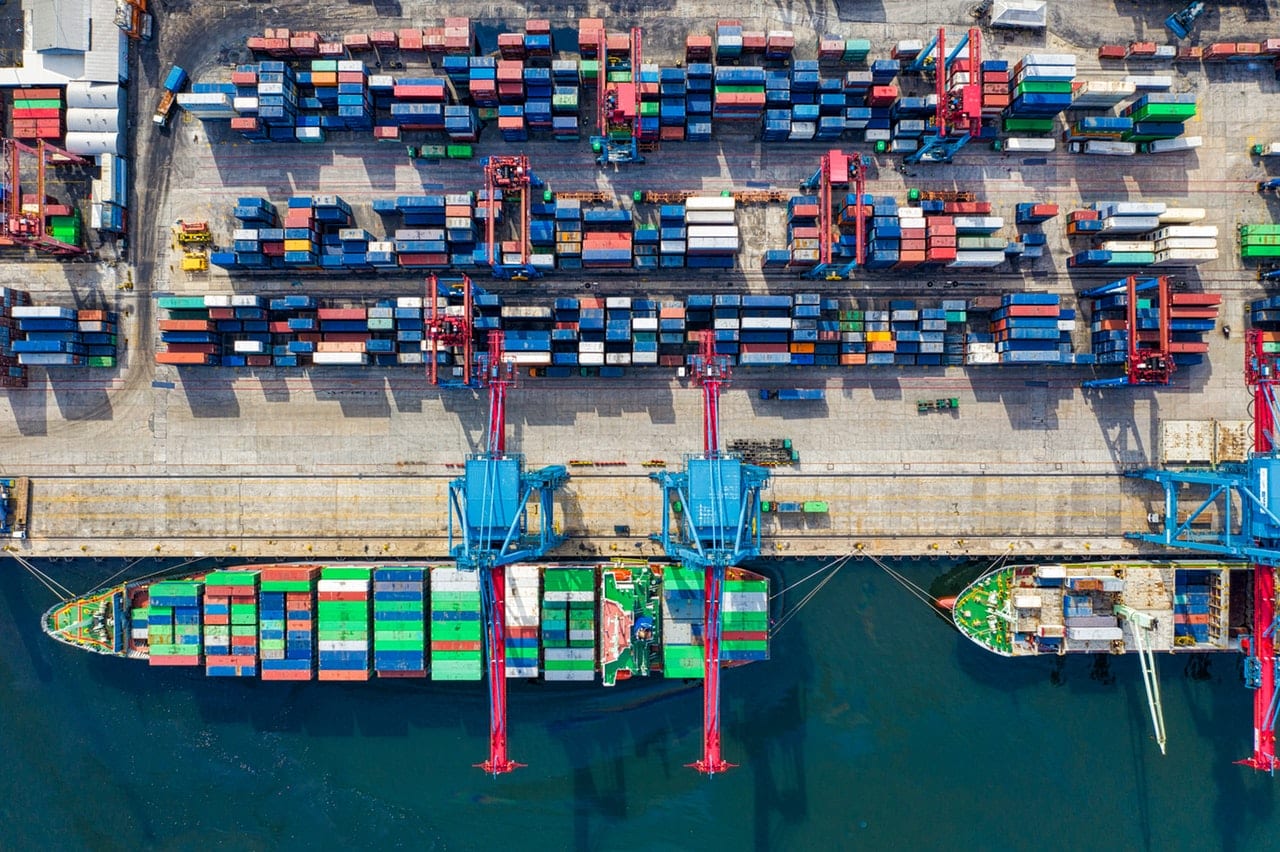

As trade talks between the world’s two biggest economies resumed in Shanghai on Tuesday, Trump warned China against trying to wait out his first term in office to finalise a deal.

Apple Inc.’s results after markets close illuminate the impact of trade tensions with China. Shares of the iPhone maker were down 0.08%, contributing the most to the tech sector’s 0.5% drop.

Trade and iPhone demand in China are going to be part of the issue. But on the flip side, the transition Apple is making from a hardware company to a services company is going to be closely watched, said Joseph Sroka, chief investment officer at NovaPoint in Atlanta.

Market participants are looking ahead to the Fed’s statement at the conclusion of its two-day meeting on Wednesday for clues as to how the central bank will proceed through year-end.

Many analysts believe a 25-basis-point cut in interest rates is fully priced into the market.

There’s a high expectation that the Fed is going to lower short-term interest rates and that’s been a driver of the markets over the last few weeks, said Sroka.

Commerce Department data showed U.S. consumer spending and prices rose moderately in June, pointing to slower economic growth and bolstering the case for monetary easing.

The Dow Jones Industrial Average fell 30.26 points, or 0.11%, to 27,191.09, the S&P 500 lost 7.24 points, or 0.24%, to 3,013.73he Nasdaq Composite dropped 13.05 points, or 0.16%, to 8,280.28.

Just over half of the S&P 500 companies have released second-quarter earnings, of which 75.9% have beat bottom-line analyst expectations, according to Refinitiv data.

Procter & Gamble Co jumped 4.3% after the consumer products maker beat quarterly revenue estimates, limiting losses on the blue-chip Dow index. 4.3

Shares of Capital One Financial Corp fell after the credit-card issuer said information on 106 million people had been compromised.

Pfizer Inc.’s stock dropped 6.6%, weighing the most on the healthcare index, after brokers downgraded the stock following the drugmaker’s announcement on Monday that it would spin off its Upjohn unit and merge it with Mylan.

Merck & Co Inc. edged higher after reporting better-than-expected second-quarter results and raising its full-year earnings forecast.

Advancing issues outnumbered declining ones on the NYSE by a 1.15-to-1 ratio; on Nasdaq, a 1.72-to-1 ratio favoured advancers.

The S&P 500 posted 28 new 52-week highs and 1 new low; the Nasdaq Composite recorded 66 new highs and 82 new lows.